The Walt Disney Company (NYSE:DIS) Board of Directors today sent a letter to shareholders detailing the progress it has made and continues to make on its strategic priorities, delivering on the promises it made just over one year ago.

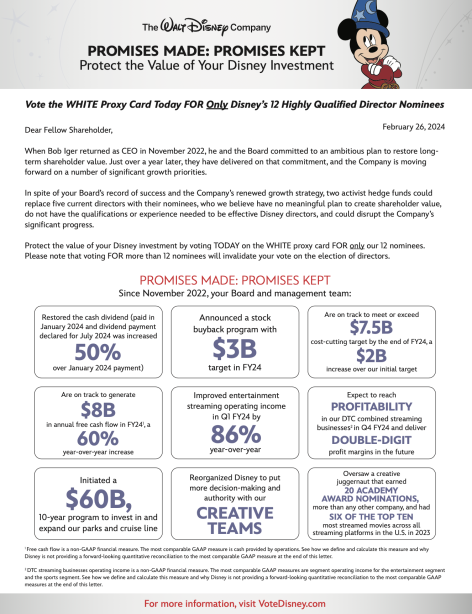

The Board has been laser-focused on a strategy that will drive shareholder value"Juegos De". The Company has restored its cash dividend and subsequently increased the dividend payment declared for July 2024 by 50%. Disney is also targeting $3 billion in share buybacks for FY24. As shared in its first quarter earnings, the Company has also made great strides in reigning in costs and is on track to meet or exceed its cost cutting target of $7.5 billion by the end of FY24. Disney also reaffirmed it is on track to deliver $8 billion in free cash flow¹, and to reach profitability in its combined DTC streaming businesses² in Q4 FY24. Disney’s creative engines continue to be recognized with numerous nominations across the TV and film industry.

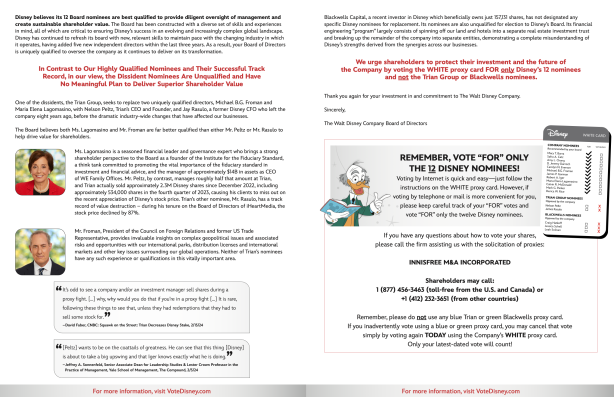

Disney’s Board of Directors believes all of its 12 nominees are uniquely qualified to continue this important progress and create long-term shareholder value. The Board urges shareholders to protect their investment and the future of the Company by voting the WHITE proxy card FOR only Disney’s 12 nominees NOW and not the Trian Group or Blackwells nominees. The 2024 Annual Meeting of Shareholders will be held on April 3, 2024.

The Disney Board of Directors does not endorse the Trian Group nominees, Nelson Peltz and Jay Rasulo, or the Blackwells nominees, Craig Hatkoff, Jessica Schell and Leah Solivan, Juegos De 20 and believes that they are unqualified to serve on Disney’s Board and preserve value creation for shareholders in this increasingly complex global landscape.

The Company’s proxy statement and other important information related to the Annual Meeting can be found at VoteDisney.com.

[1] Free cash flow is a non-GAAP financial measure. The most comparable GAAP measure is cash provided by operations. See how we define and calculate this measure and why Disney is not providing a forward-looking quantitative reconciliation to the most comparable GAAP measure at the end of the attached shareholder letter.

[2] DTC streaming businesses operating income is a non-GAAP financial measure. The most comparable GAAP measures are segment operating income for the entertainment segment and the sports segment "Flash Old Online". See how we define and calculate this measure and why Disney is not providing a forward-looking quantitative reconciliation to the most comparable GAAP measures at the end of the attached shareholder letter.